Agência de risco rebaixa a nota do Brasil para BBB- Nota de crédito da dívida foi revisada de 'BBB' para 'BBB-. Apesar do rebaixamento, Brasil ainda mantém 'grau de investimento'.

A agência Standard & Poor's rebaixou nesta segunda-feira (24) a nota de crédito soberano do Brasil em um nível, de 'BBB' para 'BBB-', mas ainda dentro da faixa de grau de investimento. A S&P também mudou a perspectiva do rating de negativa para estável.

A Standard & Poor's justificou sua decisão pelos sinais pouco claros da política econômica do governo da presidente Dilma Rousseff, que enfrenta um frágil quadro fiscal, assim como pela desaceleração do crescimento do país. A agência considera que o país ainda é considerado seguro para investir, mas que altos gastos do governo e baixo crescimento levam a um aumento de risco.

Em comunicado, a S&P disse que o rebaixamento do rating reflete a combinação de "derrapagem orçamentária" em meio as perspectivas de "crescimento moderado nos próximos anos" e de baixo volume de investimentos.

O rebaixamento da nota do Brasil já era esperado por parte do mercado e acontece duas semanas após o ministro da Fazenda, Guido Mantega, ter recebido a visita de uma representação da agência de classificação, que veio ao país colher dados sobre a situação econômica brasileira e contas do governo

A nota do Brasil na classificação feita pela S&P estava em BBB desde novembro de 2011. No ano passado, o país passou a ser indicado pela agência com perspectiva negativa.

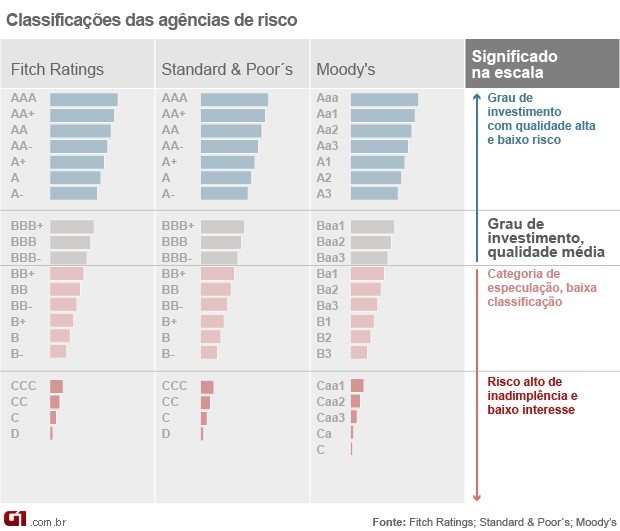

A S&P é a primeira das agências de classificação de risco a rebaixar a nota do Brasil para o primeiro degrau do grau de investimento. Pela Moody´s e Fitch, o rating do Brasil permanece no segundo degrau desde 2011.

Quanto maior o rating de um país, melhor ele é sob o ponto de vista de atração de investimentos. A nova nota representa o primeiro degrau na escala considerada "grau de investimento", dada a países avaliados como investimento seguro pelas agências.

No mercado financeiro, o rating de um país funciona como um "certificado de segurança" que as agências de classificação dão a países que elas consideram que são bom pagadores de seus compromissos.

Confira abaixo a íntegra da nota da agência em inglês:

On March 24, 2014, Standard & Poor's Ratings Services lowered its long-term

foreign currency sovereign credit rating on Brazil to 'BBB-' from 'BBB' and

its long-term local currency rating to 'BBB+' from 'A-'. The outlook on our

long-term credit ratings is stable.

We lowered the short-term foreign currency credit rating to 'A-3' from 'A-2',

while the short-term local currency rating is unchanged at 'A-2'. The transfer

and convertibility assessment was lowered to 'BBB+' from 'A-'.

Our 'brAAA' national scale rating on Brazil remains unchanged, and the outlook

on the national scale rating remains stable.

RATIONALE

The downgrade reflects the combination of fiscal slippage, the prospect that

fiscal execution will remain weak amid subdued growth in the coming years, a

constrained ability to adjust policy ahead of the October presidential

elections, and some weakening in Brazil's external accounts. Low growth

prospects reflect both cyclical and structural factors, including investment

as a share of GDP of only 18% in 2013 and a slowdown in growth in the labor

force. Combined, these factors underscore the government's diminished room for

maneuver in the face of external shocks.

The credit ratings on Brazil reflect its well-established political

institutions, broad commitment to policies that maintain economic stability,

and its large and diversified economy. Following deterioration in the current

account deficit and some moderation in foreign direct investment (FDI)

inflows, net external debt levels are rising but remain manageable. Brazil's

general government debt burden is high, but its composition remains solid

(denominated overwhelmingly in local currency and mostly at fixed- or

inflation-linked rates). These factors underpin the low-investment-grade

ratings.

Brazil's fiscal deterioration during the past several years includes somewhat

higher deficits as a result of a lower primary (or non-interest) fiscal

surplus and ongoing off-budget activities. Credibility around the conduct of

fiscal policy systematically weakened as the government exempted various

spending and revenue items from the fiscal target, in addition to lowering the

target itself over time. Persistent use of state-owned banks, financed by

"below the line" funding from the Treasury, also undermined policy credibility

and transparency. Fiscal execution, such as that in 2013, has become more

reliant on receiving "non-current" or one-off revenues and adjusting the

timing of spending outlays to meet official fiscal targets.

Policy signs ahead of the October presidential election to stem the fiscal

slippage this year are mixed. In addition, so are prospects for adjustment

after the election, in our view. Despite the recent budgetary reprogramming

effort that cuts some spending from the 2014 budget passed by Congress, it

will be difficult to achieve the formal 1.9% of GDP primary surplus target

without recourse to "one-off adjustments," in our view, given low growth and

the continuation of some tax exemptions. The implementation of the recently

announced measures to manage losses in the electricity sector (given low

rainfall and reliance on high cost thermal energy) with a limited increase in

electricity tariffs in an election year may be challenging. Whereas these

measures are in line with recent history of quasi-fiscal activity, the

government appears to be reducing the pace of lending from state-owned banks,

and with it "below the line" financing for them from the Treasury; if that

remains on track, over time it could be supportive for the rating. However,

other downside fiscal risks stem from the performance of state and local

governments (whose shortfalls are no longer compensated for by the federal

government) and the impending ruling from the Supreme Court regarding savings

accounts (that may result in the federal government having to fund losses in

the banking sector). Combined these factors could put additional pressure on

Brazil's future fiscal performance.

We expect low growth in Brazil to persist over the next several years with

real GDP expanding by 1.8% in 2014 and 2% in 2015. This outlook reflects some

modest improvement in exports this year, and an expected stronger contribution

in 2015, from lagged effects of real depreciation. Following many delays, the

government's important concession program is slowly advancing and should

provide some support for investment. That said, we still expect overall

private-sector investment to remain lackluster given persistent negative

business sentiment and a wait-and-see attitude associated with the election,

the risk of energy rationing, and the lagged effects of the 350-basis-point

rise in the monetary policy rate since April 2013. We expect the pace of

household spending to be constrained by higher consumer indebtedness and more

moderate job creation and real wage gains. The prospect for at least some

additional fiscal and monetary tightening after the elections (assuming some

electricity and energy prices increases) is likely to keep growth little

changed next year, in our view.

We expect general government debt, net of liquid assets (not including

international reserves), to rise somewhat in 2014 and 2015 to around 44% to

45% of GDP. We project that the general government deficit will rise toward

3.9% of GDP, from 3.2% in 2013, on a lower primary surplus result relative to

2013 and the government's target, and higher interest rates, with interest as

a percent of revenues over 13%. We expect some decline in the deficit

beginning 2015, reflecting prospects for a somewhat tighter fiscal policy

following the election. However, there is uncertainty on its size and scope.

The larger change in general government debt to GDP vis-à-vis the deficit

incorporates "below the line" fiscal spending, besides some fluctuations in

central bank repo operations.

We expect Brazil's external vulnerability will rise somewhat over the next

several years. In 2013, FDI did not fully cover Brazil's current account

deficit; we expect this trend to continue, with narrow net external debt set

to rise to over 20% of current account receipts from an average 10% over the

past five years. Our estimates of external debt are calculated on a residency

basis. They include nonresident holdings of locally issued Brazilian

real-denominated government debt estimated at about US$139 billion (47% of

current account receipts) in 2013. They do not include, however, debt raised

offshore by Petrobras and upstreamed in the form of FDI to the head office.

That said, despite the wider current account deficit, more than 3.5% of GDP,

Brazil has comparatively low external financing needs vis-à-vis some peer

issuers owing in large part to its high level of international reserves.

Our higher local currency rating on Brazil reflects the credibility of its

monetary policy, its floating exchange-rate regime, and the depth of its

capital markets.

OUTLOOK

The stable outlook reflects our view that Brazil's institutional and policy

framework coupled with its fiscal and external balance sheet strengths afford

it sufficient room for maneuver and the ability to withstand external shocks

consistent with a low-investment-grade rating.

We could raise the ratings following more consistent policy initiatives to

strengthen the fiscal accounts or outline a more proactive reform agenda to

put medium-term growth on stronger trajectory. This would likely generate

greater private-sector confidence and higher investment and afford the

government more fiscal and monetary flexibility.

We could lower the ratings following a sharp deterioration in Brazil's

external and fiscal indicators that is coupled with an unraveling of Brazil's

past commitment to pragmatic policy. Notwithstanding the downgrade, we see

Brazil's broad macroeconomic policy framework as supportive of its

investment-grade ratings.

Comentários